Wallester Business Review, Prices And Ratings (Guide 2025)

All products and services featured are independently selected by WikiJob. When you register or purchase through links on this page, we may earn a commission.

- Who Is Wallester Business For?

- Wallester Business Key Advantages

- Wallester Business Products and Services

- Wallester Business Platform Features and Tools

- Wallester Business Account Types

empty

empty

empty

- Wallester Business Commissions and Fees

empty

empty

- Advantages of Wallester Business

- How to Set Up an Account With Wallester Business in 2025

Wallester Business is a financial product created by the Estonian licensed company Wallester AS.

The company develops effective fintech solutions that simplify and automate all business processes related to financial management.

Wallester AS provides the full range of white-label services, issues all types of VISA cards and gives other companies access to all VISA programs via BIN sponsorship.

The Wallester Business platform offers a set of services, including card issuing, payment processing, reporting, invoicing and budget management.

Wallester Business is designed to be user-friendly and efficient, making it an excellent option for businesses of all sizes.

Who Is Wallester Business For?

Wallester Business is designed for companies of all sizes, from small startups to large corporations.

It is an excellent option for businesses that need to manage their finances across different countries.

The product is extremely useful for E-commerce marketplaces, financial institutions, streaming platforms, marketing agencies, travel industry representatives and many other companies from different spheres and countries.

Wallester AS is licensed by the Estonian Financial Supervision Authority. The company has the status of VISA Principal Member, is a member of the VISA Ready and VISA Fintech Fast Track programs. The headquarters of Wallester AS is located in Tallinn (Estonia). The company's services are available in all countries of the European Economic Area (EEA).

Wallester Business Key Advantages

- Possibility for company of any size within EEA/UK to open Business account for FREE (cards both virtual and physical work worldwide)

- No top up fee, 300 virtual cards for Free

- Much cheaper and more convenient solution in comparison to traditional banks

- European BIN, cards work great with Facebook/Google and other platforms

- Opportunity to instantly issue an unlimited amount of cards

- Possibility to purchase separate BIN for your company's needs

Wallester Business Products and Services

The program considers all the diverse needs of modern business and meets all requirements of payment card issuing.

Its wide range of services includes:

- Virtual and physical corporate cards issuance

- Transaction monitoring in real-time and limit regulation

- Receiving detailed reports on all corporate expenses

- Budget management through integrated accounting services

- Confirming purchase requests from employees

- Uploading invoices via app for accounting

- Instant issuance of virtual cards for media buying

Wallester Business Platform Features and Tools

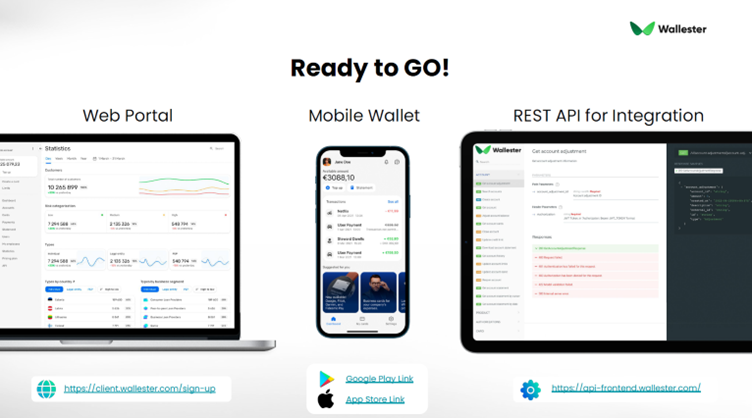

Wallester Business includes a range of efficient tools to help businesses manage their finances. These include:

-

Corporate expense card issuing – Companies can issue their own corporate cards. Both virtual and physical cards can be issued – according to business goals and strategies. As part of your Wallester Business account, you can quickly issue payment cards in any quantity, while the issuance of ready-to-use virtual cards is carried out instantly. All cards can be connected with mobile payments such as Apple Pay, Google Pay, and Samsung Pay.

-

Full expense control – Platform allows to monitor all transactions in real time and gives total control over card limits. All digital accounts are at hand, and monitoring financial flows is straightforward and convenient. The solution helps optimize budget management for both a small startup and a large corporation.

-

Payment approval – Wallester Business offers the easiest way of corporate payment approval. Employees make purchase requests and managers promptly validate them using the platform confirmation system. The product helps to save time on formal procedures and will be extremely useful for companies whose employees regularly make corporate purchases and other payment transactions.

-

Reporting tools – Wallester Business provides businesses with a set of reporting tools to help them analyze their financial data. Businesses can generate reports on transaction history, account balances, and other key metrics. Expense information is broken down into categories, and a report is kept of each corporate payment or request. Reports are instantly uploaded to the user's account, while access to them is possible in real time.

-

Integration with accounting software – Wallester Business integrates with popular accounting software, making it easy for businesses to manage their finances and stay up-to-date with their accounting records.

Wallester Business Account Types

Wallester Business offers different account types to suit the needs of different businesses.

These include:

Free Package (€0/month)

This is a basic tariff plan that is suitable for small businesses that are just getting started.

It includes:

- Basic platform features

- Up to 300 virtual cards

- Additional virtual cards (€0.35/month per card)

- Unlimited number of physical cards

Premium Package (€199/month)

This account is designed for growing businesses that need more advanced features to streamline financial processes, expense control and payment management.

It includes:

- All basic platform features, plus

- Up to 3,000 virtual cards

- Additional virtual cards (€0.20/month per card)

- Unlimited number of physical cards

Platinum Package (€999/month)

The type of account with complete platform functionality for any business goals. It is designed for large corporations that require custom solutions and includes:

- All premium platform features, plus

- Up to 15,000 virtual cards

- Additional virtual cards (€0.10/month per card)

- Unlimited number of Platinum Business physical cards

Besides, Wallester Business offers Enterprise Suite package with fully custom conditions and pricing.

It comes with onboarding assistance, custom contracts, 24/7 priority support and open access to the developer APIs.

Wallester Business Commissions and Fees

Wallester Business offers competitive fees for its services.

The fees vary depending on the account type and the services used.

Monthly Fees

| Free package | No fee |

| Premium package | €199.00/mo |

| Platinum package | €999.00/mo |

| Enterprise Suite | Custom |

| User account creation | No fee |

| Physical card issuance | No fee |

| Physical cards (unlimited) | No fee |

| Virtual cards (included in the tariff plan) | No fee |

| Additional virtual card (Free package) | €0.35/mo |

| Additional virtual card (Premium package) | €0.20/mo |

| Additional virtual card (Platinum package) | €0.10/mo |

| Virtual card replacement | No fee |

| Physical card replacement | No fee |

| Physical card delivery | €5.00 |

Businesses can contact Wallester Business for more information on fees and commissions.

Advantages of Wallester Business

Wallester Business offers several significant benefits for businesses, including:

-

User-friendly platform – The platform is designed to be user-friendly and easy to use, making it an excellent option for businesses that need to manage their finances without spending too much time on complex processes.

-

Range of services – Wallester Business offers a wide range of services to help businesses manage their finances, including payment processing, transaction monitoring, and account management.

-

Customizable dashboard – Businesses can customize their dashboard to display the information that is most important to them, making it easy to stay on top of their finances.

-

Integration with accounting software – Wallester Business integrates with popular accounting software, so that businesses can manage their finances and stay up-to-date with their accounting records.

-

Competitive fees – Wallester Business offers competitive fees for its services, making it an excellent option for businesses that want to manage their finances without spending too much money.

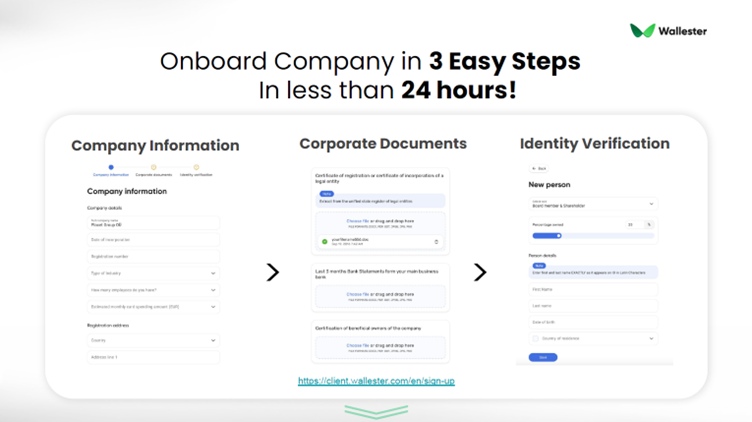

How to Set Up an Account With Wallester Business in 2025

Setting up an account with Wallester Business is simple and straightforward.

Here's how to do it:

Step 1.

Visit the Wallester Business website at business.wallester.com and click on the 'CREATE FREE ACCOUNT' button.

Step 2.

Complete the four-step registration form.

Step 3.

Once you are logged in your account, complete the verification of your account and start using the service.

Documents to Provide

Two supporting documents must be provided during the registration procedure in order to start issuing cards:

- Extract (certificate) from the register containing information about the Board Members (directors)

- Extract from the register (certificate) containing information about the owners and/or the ultimate beneficial owner

You also need to provide some basic information about the company (Registration Number, VAT number, etc.) as well as information about the company’s shareholders holding 25% or more of the capital.

In conclusion, Wallester Business is an excellent financial product that provides businesses with a range of services to manage their finances efficiently.

With its user-friendly platform, competitive fees and integration with popular accounting software, Wallester Business is an excellent option for businesses of all sizes.

If you're looking for a reliable and efficient way to manage your finances, Wallester Business is definitely worth considering.